Griffin Ardern from BloFin suggests that options traders may be purchasing ETH in the spot/futures market to hedge against short bets on bullish options, thereby increasing the bullish momentum.摘要:BloFin的GriffinArdern表示,期权交易商可能会在现货/期货市场购买ETH,以对冲看涨期权的空头押注,从而增加看涨势头。加密金融平台BloFin期权交易和研究主管格里芬·阿德恩(GriffinArdern)表示,突破心理关口在一定程度上得益于以太坊期权市场做市商或交易商的对冲活动。...

Similar situations were seen in the Bitcoin market in November, with prices accelerating to above $36,000.

The hedging activities by traders are a market dynamic accelerating the upward trend of Bitcoin (BTC) in late 2023, currently impacting the price of Ethereum (ETH).

The native token of the Ethereum blockchain, Ethereum, surged past $3,000 on Thursday. Griffin Ardern, Director of Options Trading and Research at crypto finance platform BloFin, stated that breaking the psychological barrier was partly due to the hedging activities of market makers or traders in the Ethereum options market.

According to Ardern, market makers or entities responsible for providing liquidity to the order book recently sold a lot of bullish options or bets at the $3,000 price, exposing themselves to so-called negative gamma risk exposure. Therefore, when Ethereum rebounded to near those levels, traders purchased Ethereum in the spot/futures market to hedge the upside risk and maintain an overall neutral market exposure. The hedging activity enhanced the bullish momentum, pushing Ethereum above $3,000.

Similar situations were seen in the November Bitcoin market, with prices accelerating to above $36,000.

Market makers are entities responsible for providing liquidity to the order book. They constantly take the other side of client trades, repeatedly buying and selling the underlying asset to maintain an overall neutral market book.

"A significant amount of negative gamma value for market makers is concentrated around $3,000, so market makers need to hedge the risk here. Negative gamma value means market makers sold a lot of bullish options at the $3,000 strike," Ardern pointed out. "To address this issue, market makers need to trade in the direction of the price trend - buying Ethereum as the price rises."

"The hedging plan went into effect around 6:48 AM (UTC) today," Ardern added.

Data from chart platform TradingView shows Ethereum breaking $3,000 around 08:55 UTC, reaching a high of $3032 by 09:50 UTC.

As early as mid-2023, options market makers for BTC and ETH held positive gamma exposure and traded against the price trend to dampen volatility.

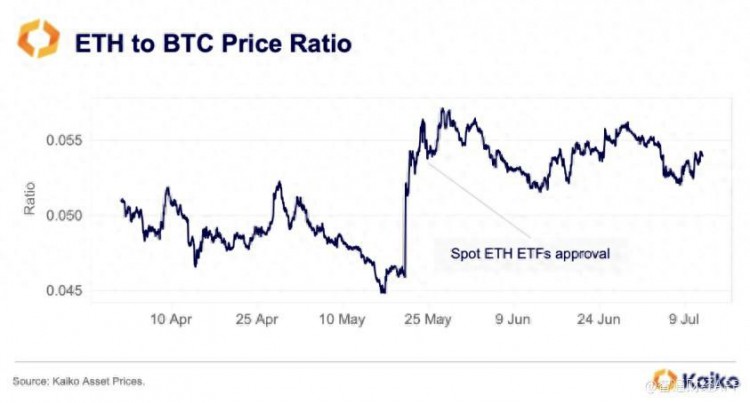

However, trader activity in the last quarter became a positive force for Bitcoin, as bullish sentiment around ETFs stimulated demand for bullish options, exposing market makers to the risk of price increases. Recently, the upcoming Dencun upgrade for Ethereum and the narrative around spot ETFs have done the same in the Ethereum market.

(Image: Hedging activities enhance bullish momentum as Ethereum accelerates to $36,000)